Sowing Trust,

Reaping Success.

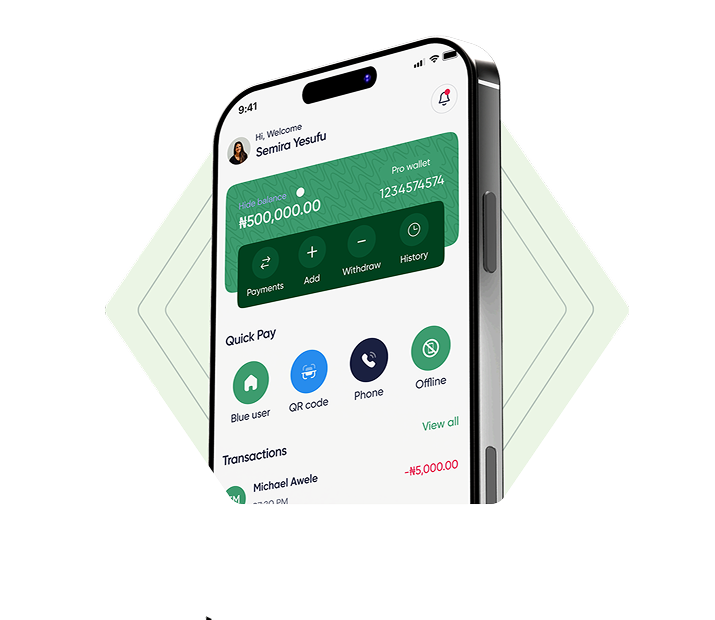

Banking doesn’t have to be complicated. We make it easier to save, borrow, and grow, with full control at your fingertips.

We are licensed by

and insured by

Bank with Koboweb.

At Koboweb Microfinance Bank, we serve both the growers and the go-getters. Our tailored solutions support a wide range of individuals—from enterprising farmers to hardworking civil servants and dynamic micro-retailers. With a focus on financial inclusion, we’re committed to delivering accessible, secure, and forward-thinking banking services that empower all members of our community to thrive.

Banking that bridges communities - with purpose.

Agribusiness Clients

Empowering Growth

Where It Begins

Start your financial journey with Koboweb's comprehensive suite of banking solutions. From savings accounts to investment opportunities, we provide the tools and support you need to grow your wealth and secure your future.

Conventional Banking Clients

Smart Banking for

Every Day

Whether you’re paying bills, managing payroll, or saving for the future, Koboweb delivers seamless, secure, and tech-enabled financial services built for modern businesses and individuals.

The Koboweb Edge

Not just banking, advantage, access, and assurance

Safe, secure, and build on trust

Community-Credit security

Your peace of mind matters. We combine robust security protocols with local trust networks to ensure your money and data stay safe.

Insurance

Protection and peace of mind

Your funds are insured for up to N250,000 by the Nigerian Deposit Insurance Corporation.

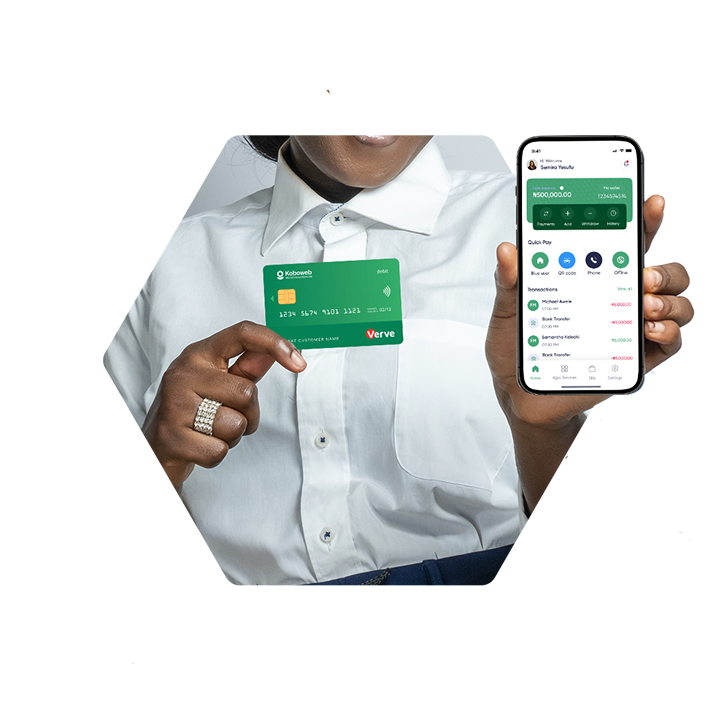

Shop securely, Spend confidently

Virtual card access

Enjoy safer online transactions with Koboweb’s virtual card feature. Your real card details stay private, while you shop or pay bills with ease and assurance.

Grow without limits

Easy Limit Upgrades

As your needs evolve, so can your banking. Seamlessly upgrade your transaction limits, whether you're expanding your farm or scaling your side hustle.

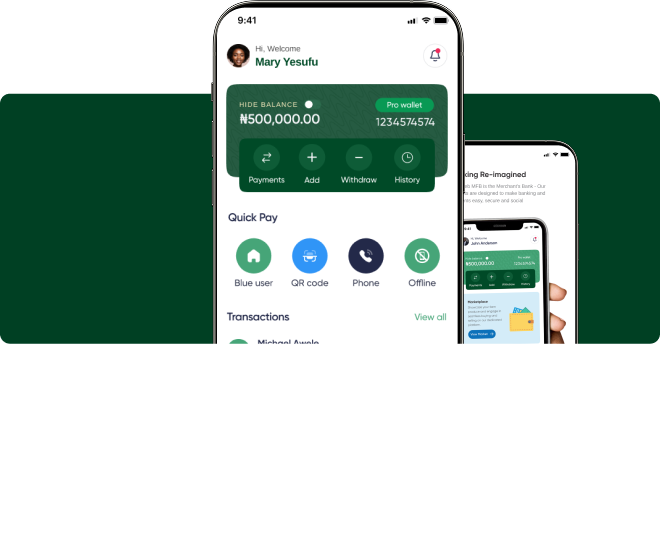

Open an account in 5 minutes

Fill in your details and verify your phone number

Provide your email and phone number and verify your phone number with an OTP.

Get verified

Select username & password. Provide your BVN and KYC details and start face & ID verification. You can then set up a PIN for managing your account.

Fund your accounts

Click on "add money" to find your account details, and top up to start making transfers.

Congratulations!

You're done